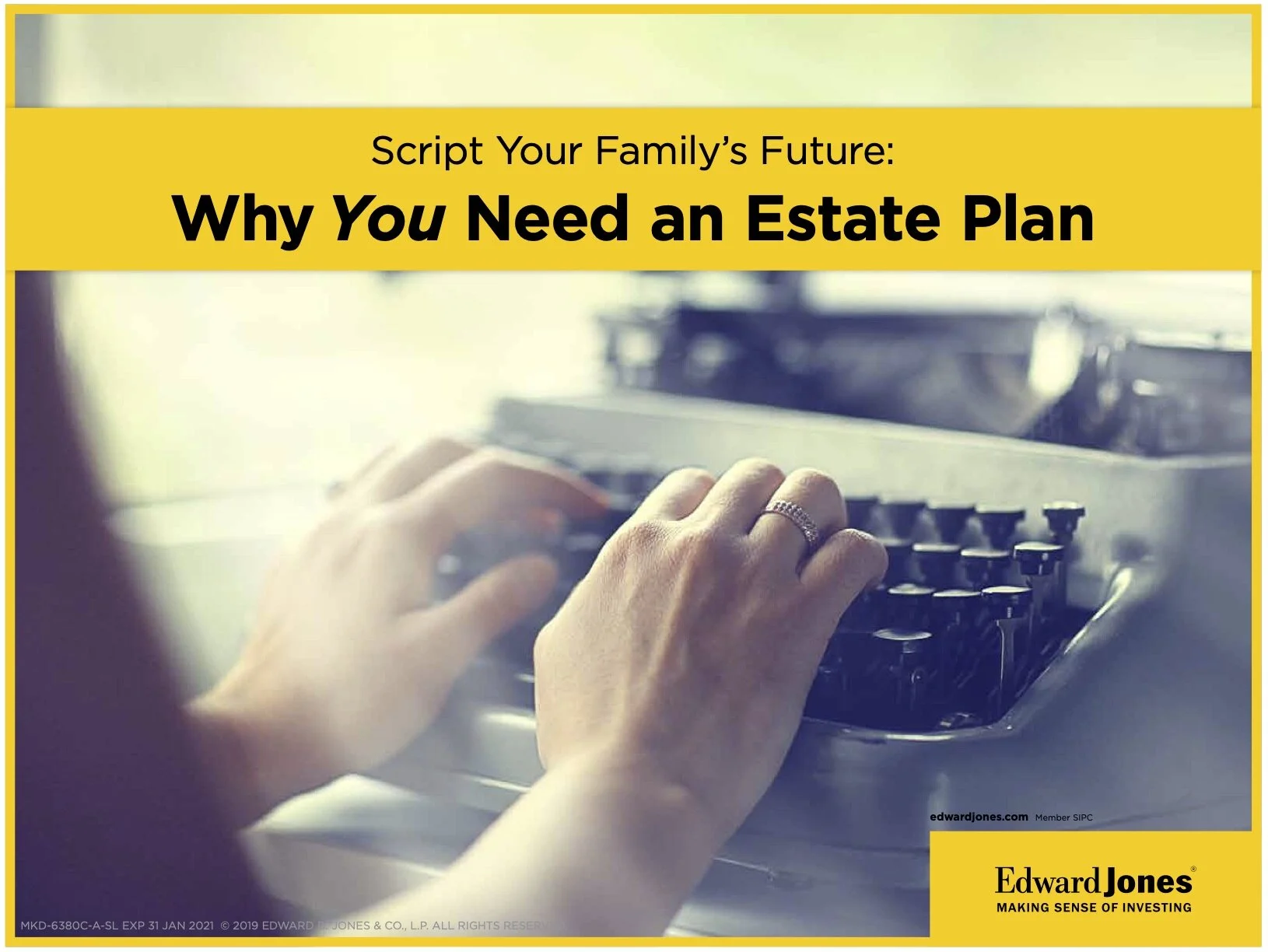

Script Your Family's Future: Why You Need an Estate Plan

Event Details • Wed, Feb. 5, 2020 at 6:00-7:30 PM

Ciao's Italian Bistro, 110 S Leroy Street, Fenton MI 48430

When it comes to your estate, even if you've taken no action at all, you still have an estate plan. Your "default plan" may be determined by the laws of your state.

We will discuss strategies you may want to consider when preparing your estate plan. Lee Napier of Edward Jones and Matthew Abraham of Abraham Law will be presenting and answering your financial and estate planning questions.

Join us for dinner and learn valuable information.

SPACE IS LIMITED • RSVP: Please call 810.629.6589

Read MoreThe ‘Setting Every Community Up for Retirement Enhancement’ (SECURE) Act of 2019 was passed and is now in effect. Because this bill was the product of actual bipartisan effort, it should give thinking Americans a major understanding of just how important this issue really is. I mean, if the two sides of the political aisle are working together (the House voted 417 to 3!!), it certainly must be that important!

There has never been a more important time to talk to your financial and legal professionals. It is urgent to explore alternative methods for estate planning and retirement savings.

Read MoreAt large gatherings of friends and family, the rule is you don't talk about politics, religion, or personal finances. So, who wants to discuss estate planning at Thanksgiving? After all, it’s a time to slow down and enjoy your family before the true holiday rush officially gets underway. Seventy percent of Americans say that their family is what they’re most thankful for as they gather around the dinner table… SO TAKE THE STEPS NECESSARY TO PROTECT THEM. It is easier than you think.

At Abraham | Law we provide practical legal services on a common-sense basis tailored to the specific needs unique to each client.

Read MoreWhat is the Difference Between a Medical and Durable Power of Attorney?

LEARN MORE

You have the freedom and ability to choose who you want to make these decisions for you and to define when and how they do so.

Estate planning can be straightforward or complex but it is vital at every level and for many reasons. It is wise for everyone to have an estate plan in place that is tailored for your specific needs and those of your family. Don’t wait to engage an estate planning attorney to create and administer your estate plan.

Read MoreThink Estate Planning is For You? Here are the Important Facts.

Estate planning may bring to mind an elderly besuited man sitting across a plush desk from an attorney, quietly discussing the disbursement of his sizeable assets to his next of kin. The notion that an estate plan is only for rich people and their business needs is simply not the case, and who better than an estate planning attorney to address this misconception?

Whether you belong to the wealthy or middle class, no matter if you’re young or old, estate planning offers necessary benefits that require your attention now.

At Abraham | Law we provide practical legal services on a common-sense basis tailored to the specific needs unique to each client.

Read MoreLiving trusts are often the topic of small talk at social gatherings or on the golf course, but not many people know what they actually do. They are “living” because they are created now, while you are alive. You sign it and it becomes an enforceable document. Your living trust can be revocable or irrevocable. A revocable trust can be revoked or amended by you

Read MoreWhether you are married or single; whether you have adult or minor children or no children, having a comprehensive and well thought-out estate plan is the smart thing to do and is always in yours and your families' best interests.

Read MoreEstate planning is the process of arranging, during a person's life, for the management and distribution of that person's estate during the person's life and at and after death, while minimizing any tax consequences. Not all estate plans are created equal and should be specific to each person, couple, or family and tailored to their unique needs. Estate planning is one of the most important steps any person can take to make sure that their final property and health care wishes are honored and that loved ones are provided for in their absence. This should include financial planning and guardian designations for any minor children as well.

Unfortunately, many people postpone even rudimentary estate planning decisions because of common misconceptions based on prevalent estate planning myths. As an experienced Michigan estate planning lawyer, Mathew Abraham often receives calls from people after they have already experienced the consequences of inadequate estate planning that results in frustrated intentions, unnecessary probate, personal family turmoil, or tax expenses and loss of control of health care decisions. This article is intended to dispel some common myths about estate planning to help promote better planning and decision-making.

Read MoreWhile estate planning objectives and the best options for achieving those goals can vary dramatically, all adults can benefit from at least a simple estate plan. A range of factors might dictate an individual’s specific estate planning needs, such as a simple will, living trust, financial power of attorney, advance health care directive and more. Unfortunately, many people postpone even rudimentary estate planning decisions because of common misconceptions based on prevalent estate planning myths. As an experienced Michigan estate planning lawyer, Mathew Abraham often receives calls from people after they have already experienced the consequences of inadequate estate planning that results in frustrated intentions, unnecessary probate, personal family turmoil, or tax expenses and loss of control of health care decisions. This article is intended to dispel some common myths about estate planning to help promote better planning and decision-making.

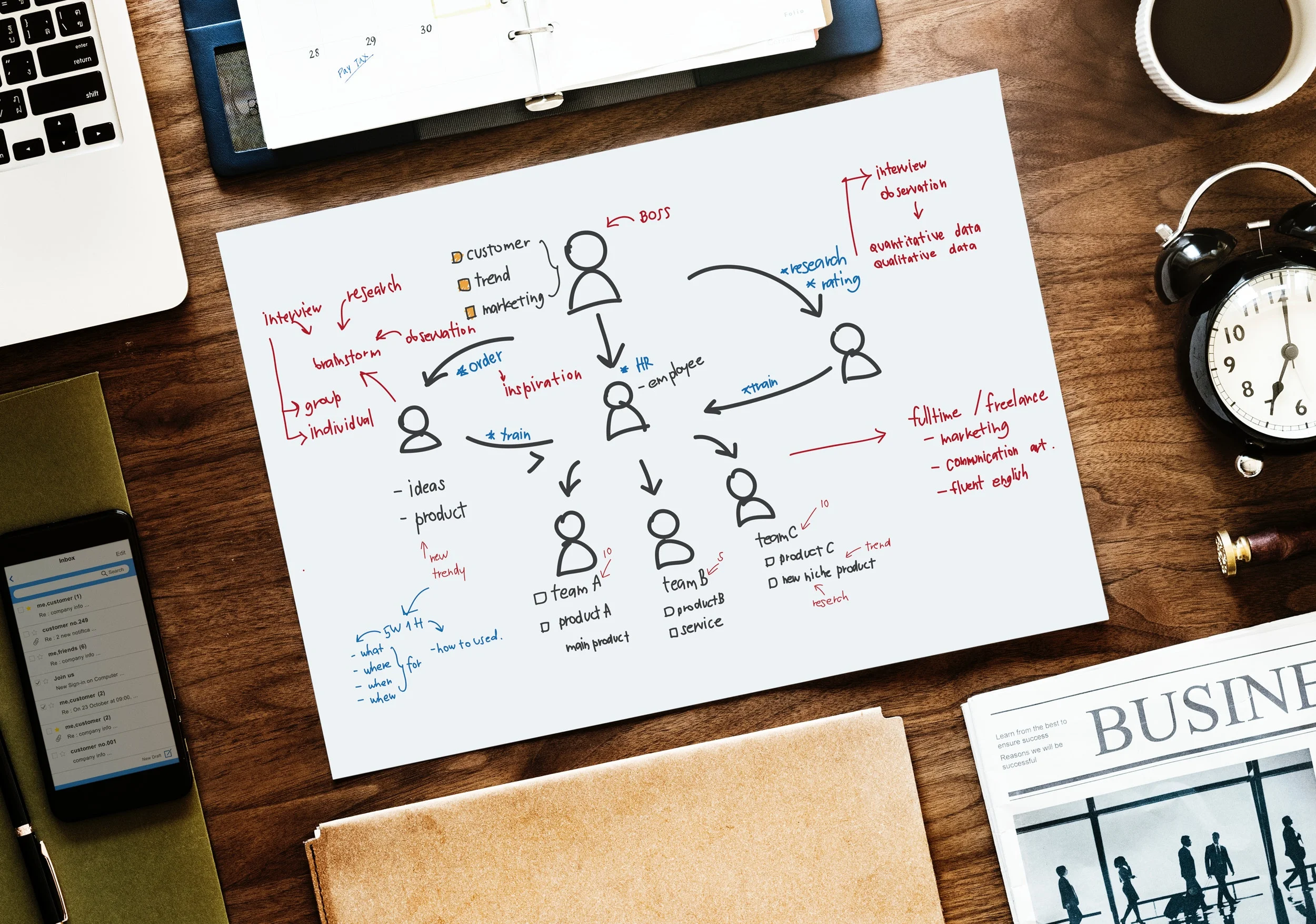

Read MoreBenjamin P. Hardy contributed an article to Inc.com that I believe might be one of the most insightful articles I've read this year. We all know much written by Mr. Hardy in this article to be true. Take a read and see for yourself. It may just give you a clearer perspective to move you forward in your endeavors, whatever they may be.

Read MoreIf you want to make your startup a success, the first thing you need to do is get into the right mindset. This might be your first venture, or you may be a veteran at launching new businesses—it doesn’t matter.

The fact is this: It’s easy to become the biggest obstacle to your own success. Your thoughts and your emotions can hold you back and get the better of you. If you don’t go into the office every single day in the right frame of mind, you’re going to end up making bad decisions.

You need to focus on what really matters if you want your startup to grow fast and succeed. Here’s what you need to focus on if you want your mindset to be a strength rather than a weakness.

Read MoreTime to update: Make sure your estate plan documents fully support your interests and those of your heirs.

An estate plan is like a car or a house: It needs regular maintenance to function as intended. Yet unlike your car or home, external events can create the need for adjustments. Among such events is legislation like the tax bill Congress passed in late December.

So this is an important time to schedule a meeting with your estate planner and be certain your plan is up-to-date. Even if your estate plan won’t be affected by the new tax law, it’s smart to confer with your estate planner periodically to be certain your current wishes are reflected in your estate planning documents.

Read MoreThe Value of Setting up a Trust for Your Children

The thought of your minor children growing up without you is enough to bring a lump to any parent’s throat. You plan to be with your children to see them grow and enjoy life, but what if something happens to both you and your spouse? You have hopefully planned to leave money for your children through life insurance. What about who would become their legal guardian? If you have significant life insurance and/or assets, your minor children could become wealthy overnight. How would they handle that responsibly?

The answer is that they would need help.

You can take one critical step now to empower yourself to have a say in how your children are raised, no matter what. By creating a will with a trust component, you will be able to choose who acts as a caretaker for your children, who handles their finances and how the assets should be distributed to reflect your wishes.

Read MoreBankruptcy Basics

For many individuals, filing for bankruptcy relief can provide a way out of debt and a fresh financial start. But whether or not a bankruptcy filing is in your best interest depends on many factors and your individual circumstances. Read on to learn more about what to consider if you are thinking about filing for Chapter 7 or Chapter 13 bankruptcy.

Read MoreBy: Matthew J. Abraham, Esq., Michigan Estate Planning Attorney

When families lose a loved one, the emotional stress and grief can make it difficult to focus on financial issues. Unfortunately, surviving family members might need access to assets of a breadwinner’s estate to provide for their basic financial needs like the home mortgage, school tuition, utility bills and even basics like groceries. When the assets of an estate are tied up in probate, the value of the estate can be diminished substantially, and access to money can be delayed for months or even years if the estate is subject to a contested probate proceeding. These are just a few reasons that most people try to avoid the probate process. While the probate of a will can raise significant issues, such as probate costs, delays in distributing residual assets and privacy violations, the situation can be far more problematic when an individual dies with no will or trust at all.

Read More

![Michigan Estate Planning Lawyer Debunks Estate Planning Myths [Part 2]](https://images.squarespace-cdn.com/content/v1/5373da14e4b0f28da14bd6e6/1538223001357-Y6PLHOCBAGHS5F38AJSW/Planning-estate-goal-matthew-abraham-law.jpg)

![Michigan Estate Planning Lawyer Debunks Estate Planning Myths [Part 1]](https://images.squarespace-cdn.com/content/v1/5373da14e4b0f28da14bd6e6/1538222091129-BG7LF3I58QS7BU84TY2N/Planning-estate-matthew-abraham-law.jpg)